This major update brings improvements in our subscriptions engine including support for physical subscriptions, subscriptions addons, recurring invoices and better control over taxes. In addition, we have implemented various feature requests from our community.

Before we start, a bit of housekeeping:

- Email blasts have a new reduced pricing of €0.002 per sent email.

- Transaction fees for offline payments (cash on delivery, bank transfer etc) are now charged at €0.15, down from €0.25 previously.

- One-time fees have been discontinued. We are working to migrate all legacy one time fees to the newly released billing plan addons engine. Note: Billing plan addons support discounts and manual taxes so it is recommended to review your setup if you were using one-time fees to avoid potential issues.

- Removed all support for legacy manual shipping taxes (pre 2020). Shipping taxes can now only be added via the "Taxes & Fees" section.

- Stripe has been made available for merchants from Mexico.

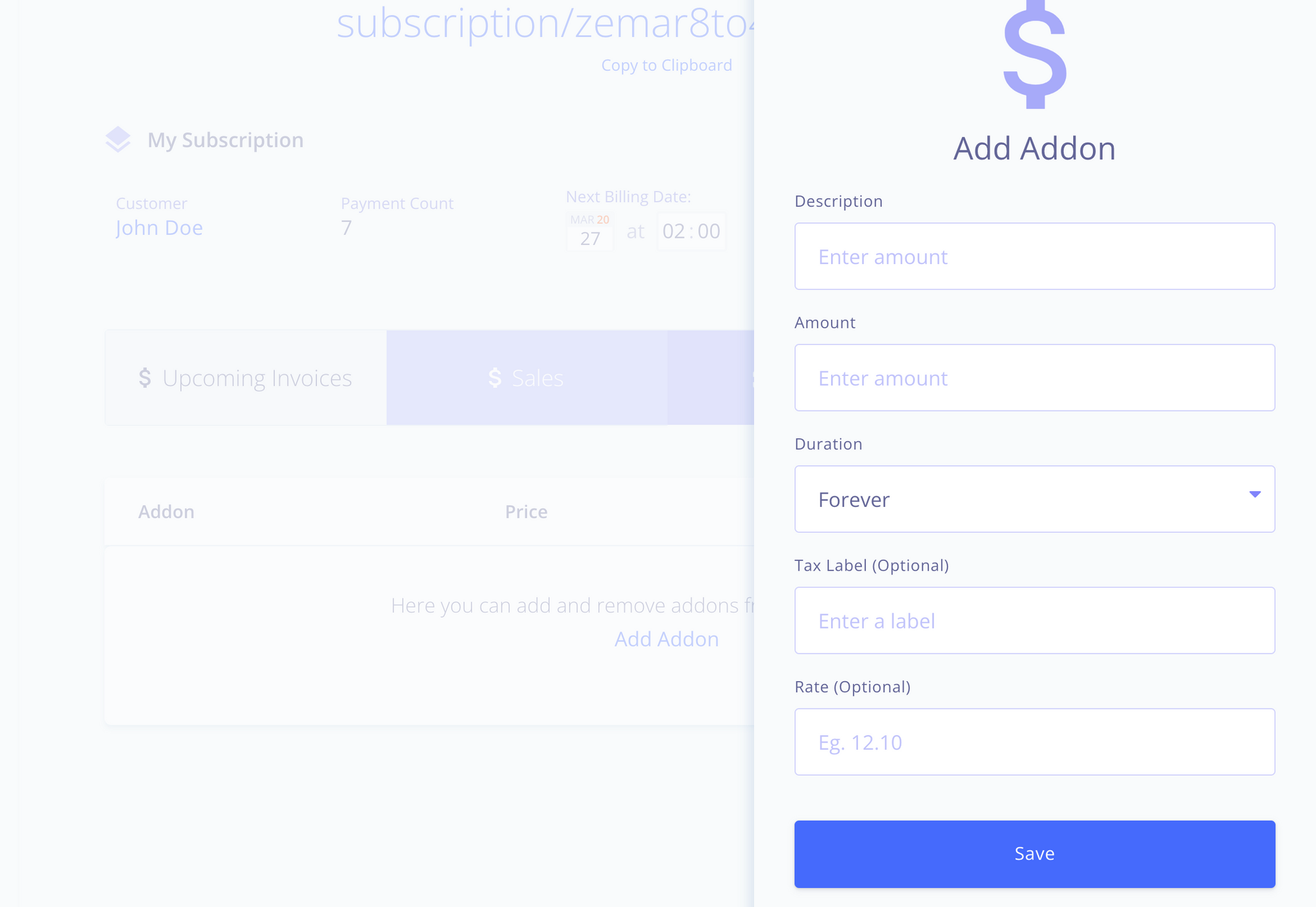

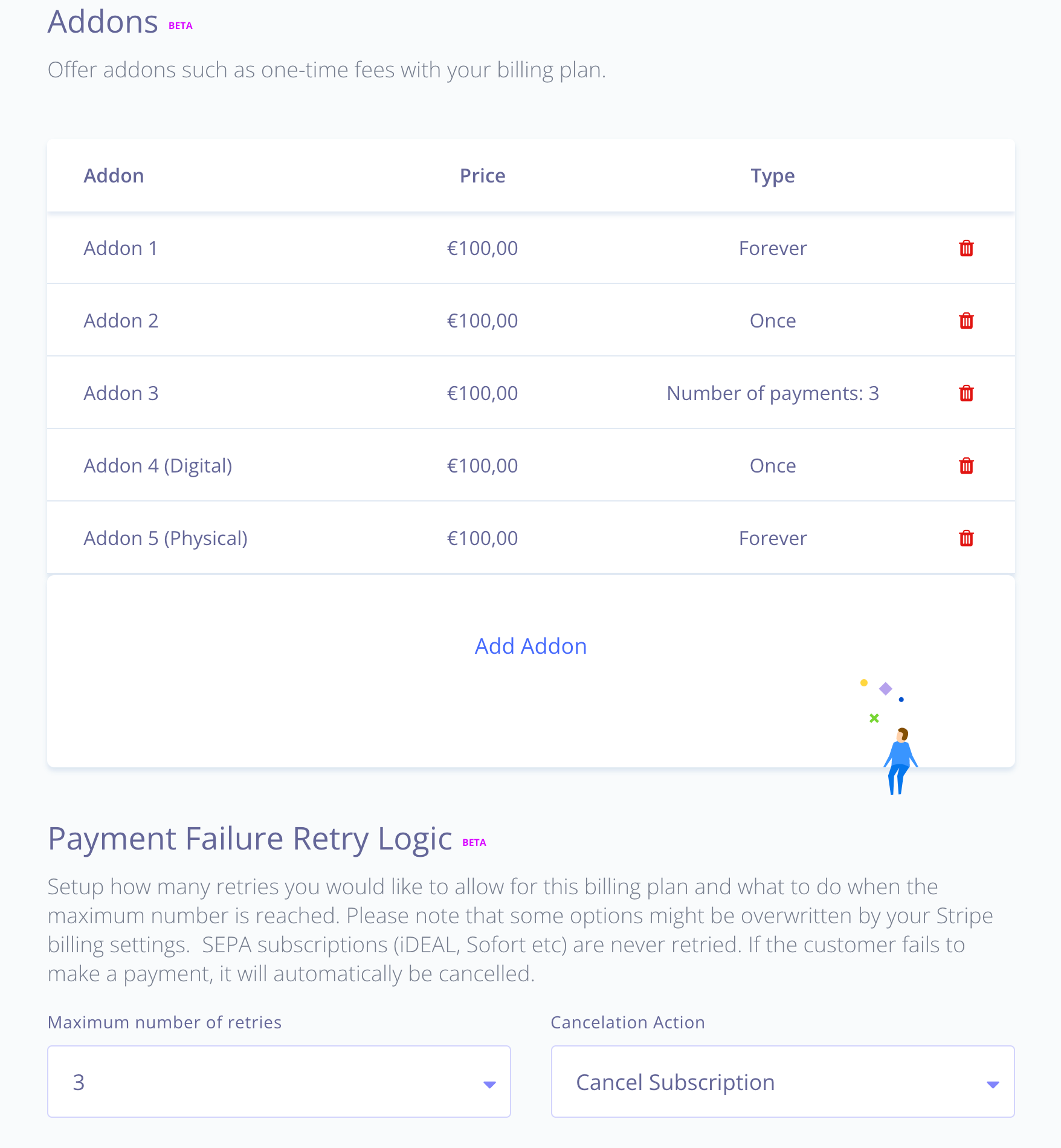

Subscription Addons

Merchants now have the ability to add and remove addons from their active Subscriptions. This is useful in cases where you offer additional services to your clients and want add the cost to their existing subscription. You can find the new addon functionality by clicking on one of your active subscriptions.

Addons have powerful options such as duration (forever, once or number of months) and support dynamic tax rates.

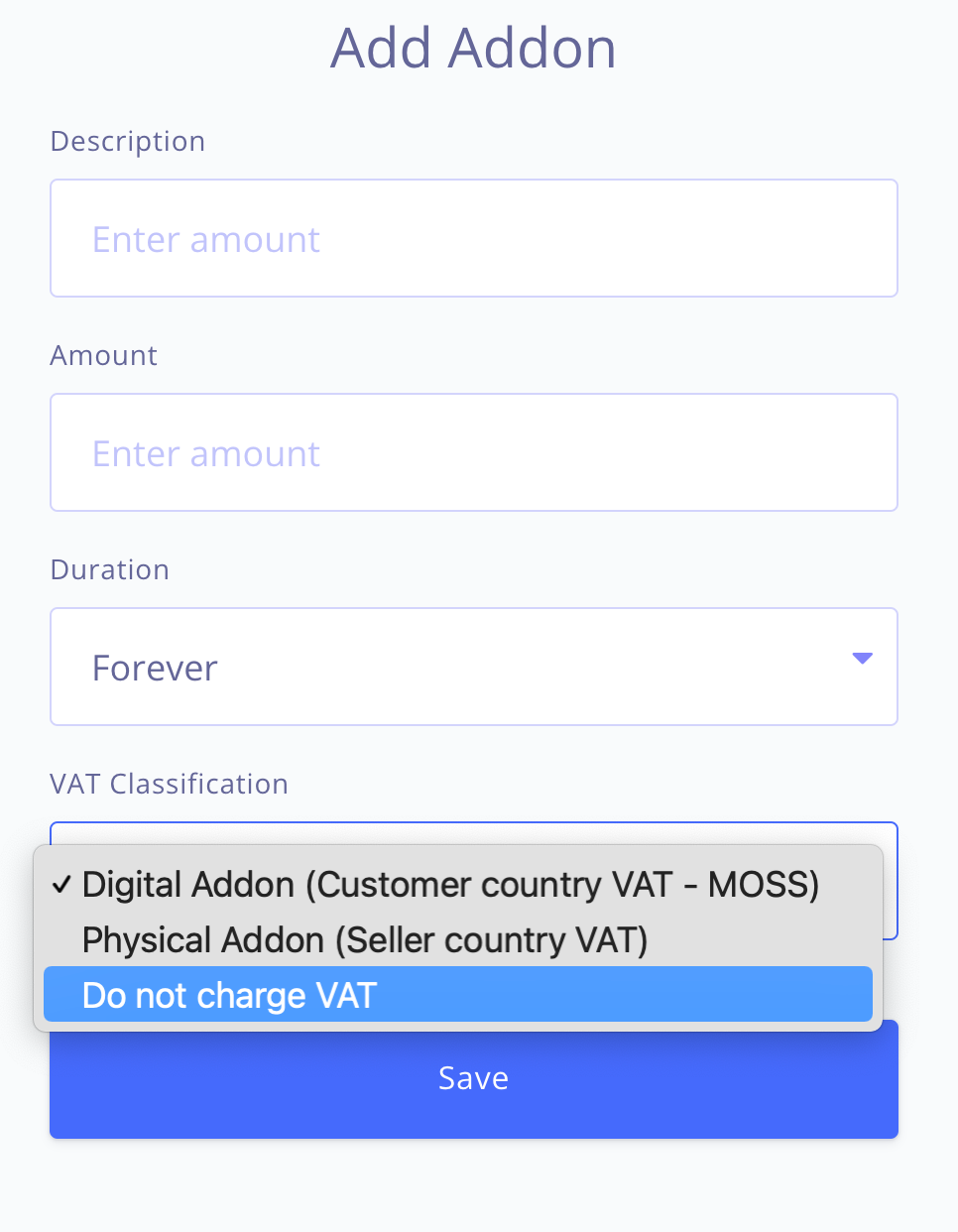

VAT compatible

Subscription addons are VAT compatible. If the subscription is billed under automated VAT rules, then when creating an addon, you will have the option to choose the VAT classification:

- Physical (Standard VAT rates - Seller country)

- Digital (MOSS VAT - Customer country)

- No VAT

We will apply the correct VAT based on this classification.

Note: If the customer has verified their VAT number and reverse charge rules are applied, then no VAT will be added.

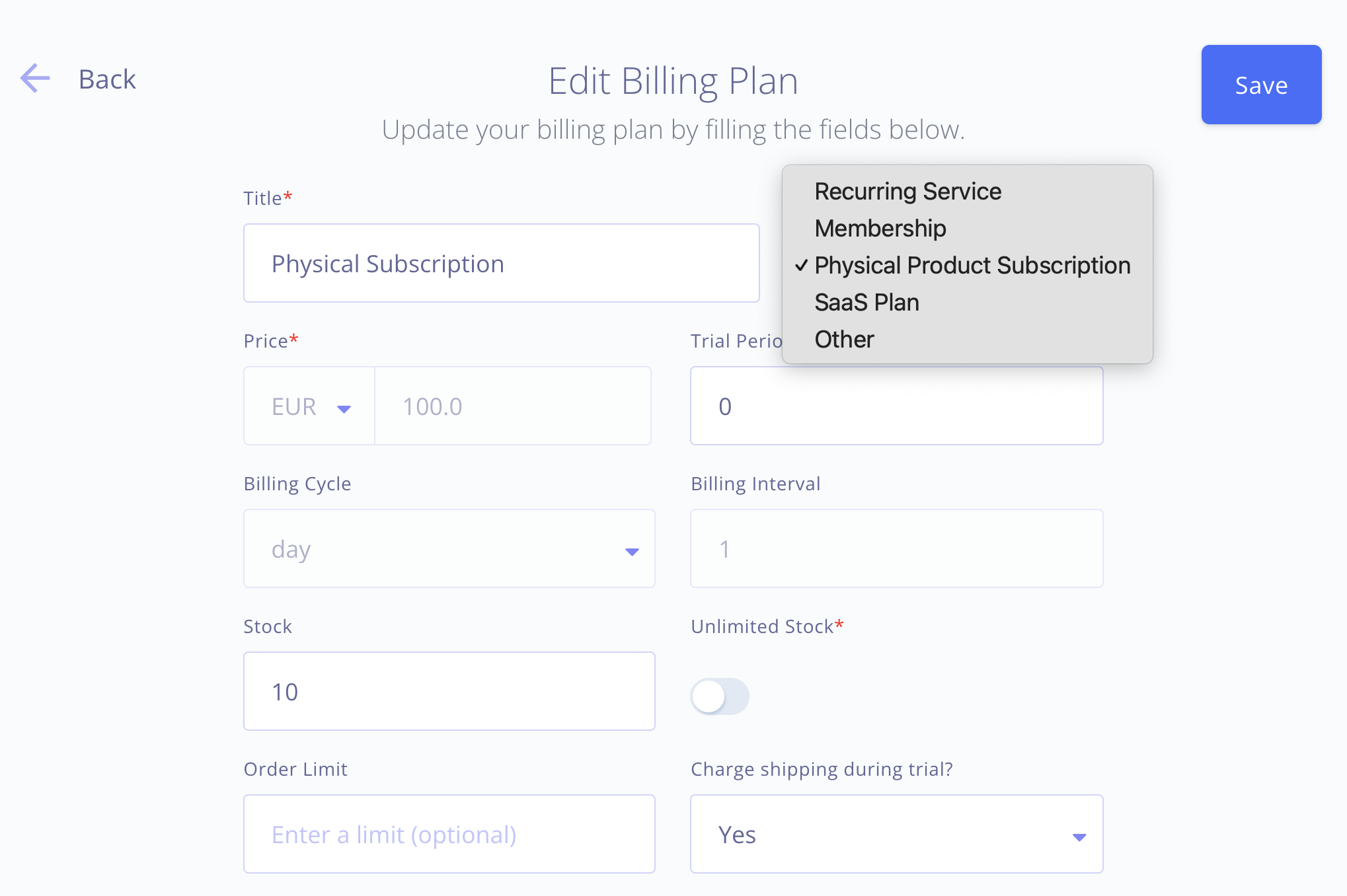

Physical Subscriptions

A highly requested feature was to add physical subscriptions that support shipping. Physical subscriptions are extremely useful for businesses that ship physical goods to their customers on a recurring basis.

To enable physical subscriptions, when creating or editing a billing plan select "Physical Product Subscription" as its category.

Physical subscriptions support all the standard billing plan options including trials and order limits. Moreover, if you offer trials then you can choose whether to charge the shipping cost during the trial period or not.

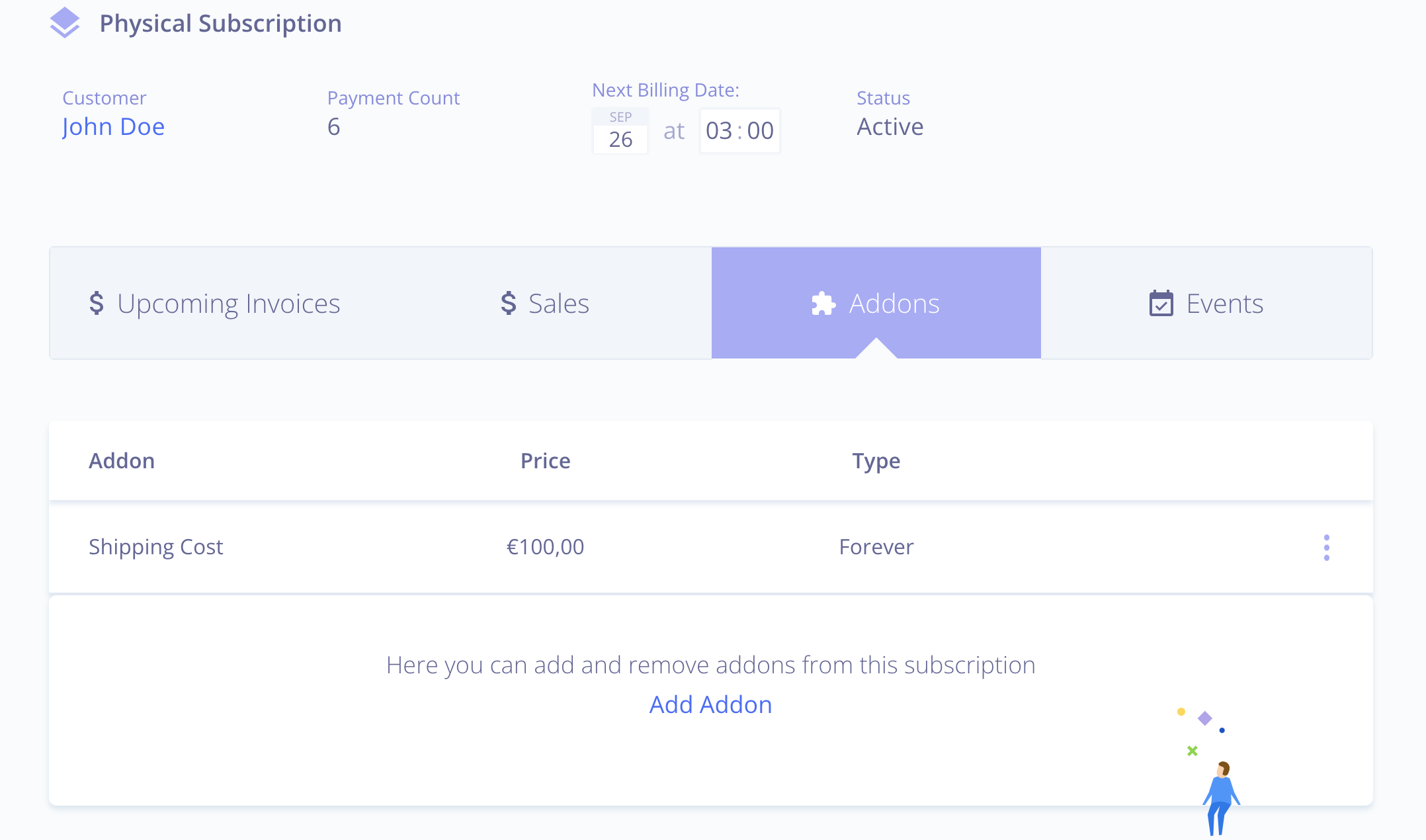

When you onboard clients on your physical subscription, you can find the recurring shipping cost as a Subscription Addon in the newly added "Addons" tab when viewing a subscription. You can remove the shipping cost from an active subscription at any point.

Recurring Shipping Cost & Bundling

The recurring shipping cost for a physical subscription is calculated by taking into consideration a variety of factors such as bundling rules, quantity, whether it was part of a larger order, trial deductions and so on.

Shipping bundling is supported for physical subscriptions. They can be bundled standalone or with other types of products such as physical products.

Additional Options:

- Charge/do not charge shipping cost during trial

- Discounts are supported by default for physical subscriptions. Discounts to the shipping cost are applied "once", "forever" or "number of months" depending on how you setup your discount. Recurring shipping discounts cannot be stacked with other types of discounts.

- VAT compatibility: VAT for physical subscriptions is charged according to the merchant's country (unless reverse charge is applied).

Billing Plan Addons (Beta)

Before this release, when merchants wanted to charge one-time fees with the billing plans they could do so by using the "one-time" fee functionality on their products. This feature has been discontinued in favour of "billing plan addons".

The key benefits of billing plan addons are:

- You can offer multiple addons on a single billing plan

- You can set their VAT classification (digital/physical) if you have EU automated rates enabled

- You can add custom taxes to addons

- You can create discounts (one time, lifetime ore recurring) for addons

- You can set an expiry duration for each addon (lifetime, once or number of payments)

Addons are listed as separate line item during checkout. If an addon is recurring, it will be also be created as a subscription addon (see top), which you can remove from an active subscription at any point.

Other Subscription improvements

- When switching a customer to a new plan, you can now choose whether the switch requires customer approval or not. If customer approval is not required, then we complete the switch immediately.

- We have added a quantity option when switching a customer to a new plan.

- We have added the option to keep an active trial (or not) when switching a customer to a new plan.

- We have added the option to choose the way subscription cancellations are handled. The available options are: 1. cancel at the end of the current billing period 2. immediate cancellation. Note that if you have webhooks configured and choose the first option, then the webhook for the cancellation event will be sent at the end of the billing period.

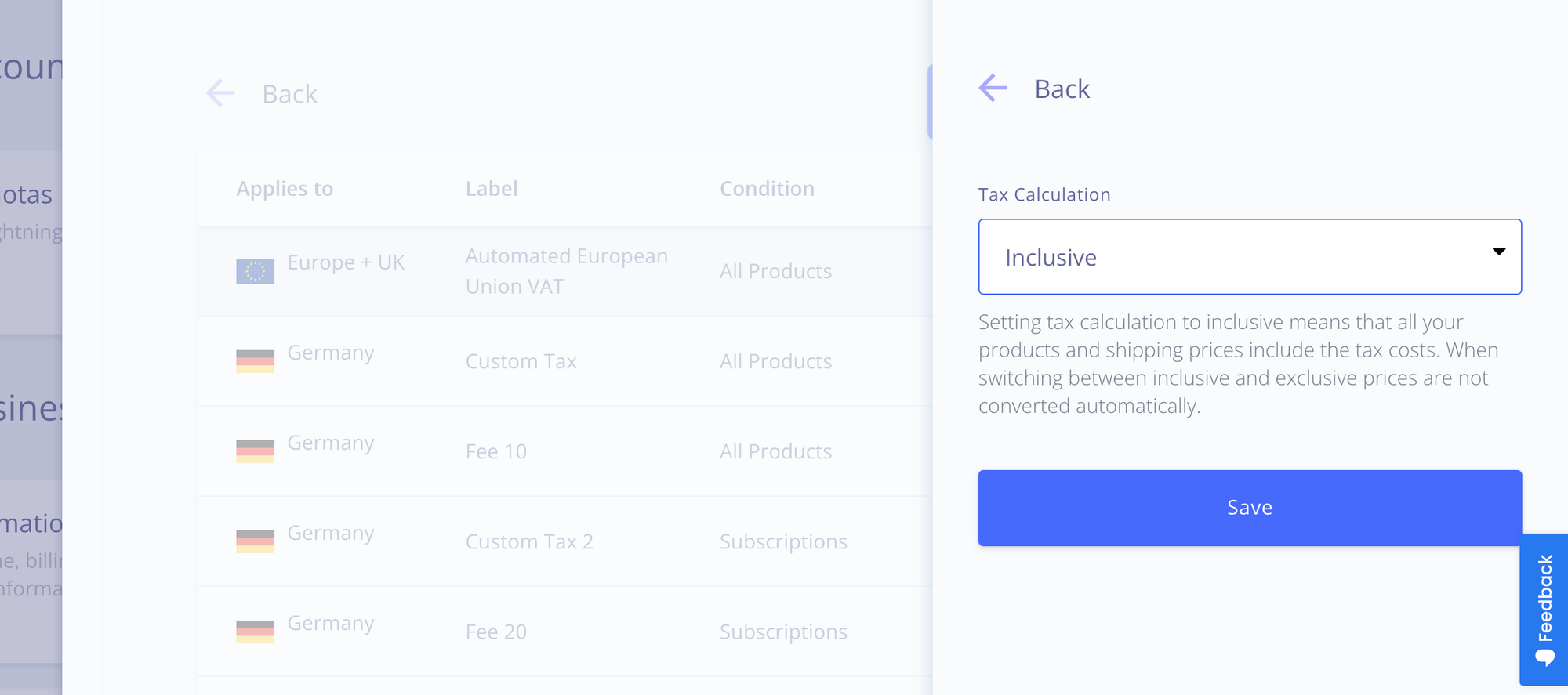

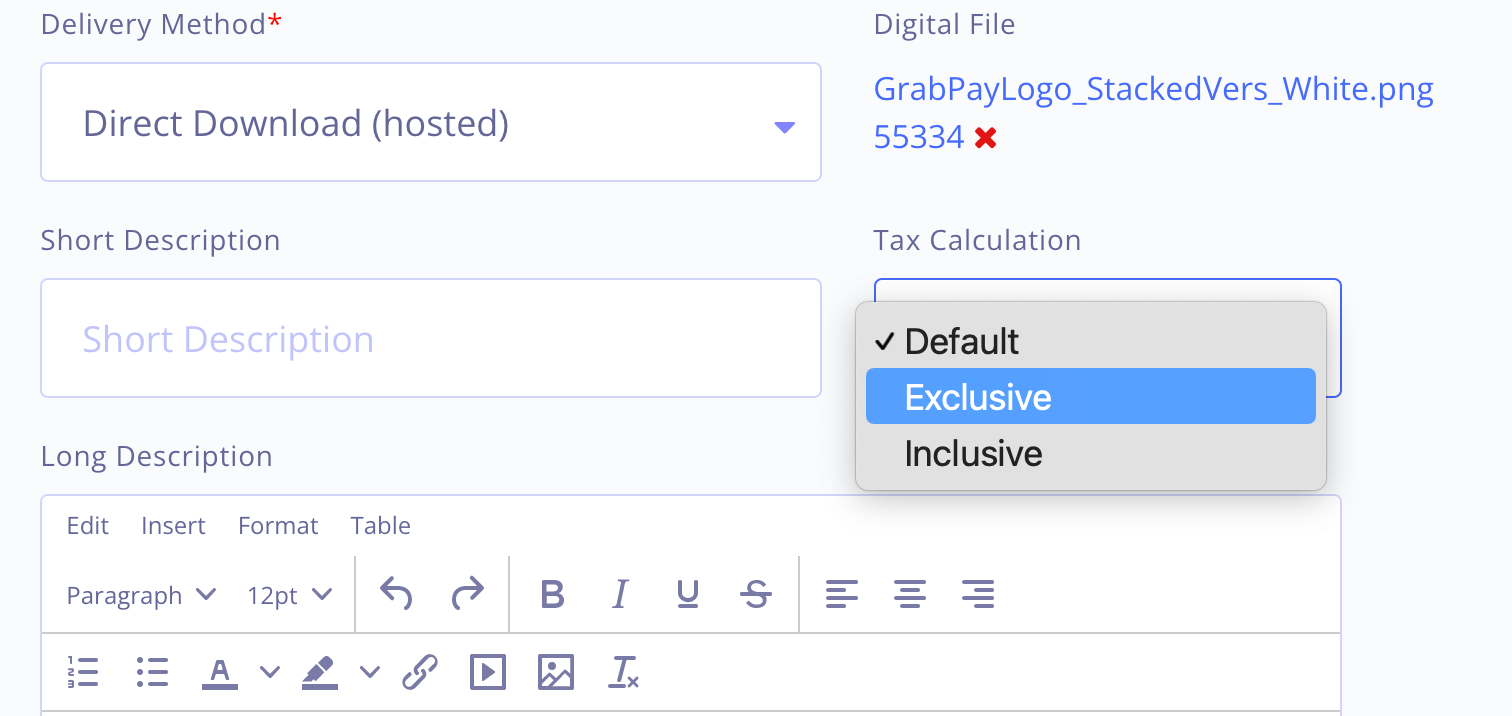

Inclusive/Exclusive Taxes (Beta)

Another highly requested feature is the option to set tax calculation as "inclusive" or "exclusive". There are two way to activate "inclusive" taxes.

- Globally (Settings -> Taxes & Fees): Changing this option will automatically update the tax calculation method on all your shopping carts and newly created custom invoices.

2. On Product-Level: You can toggle the tax calculation option when creating or editing a product.

Notes:

- Switching between "inclusive" and "exclusive" tax calculation does not convert your product prices. You will have to update them manually.

- Product level tax calculation overwrites the "Global" setting.

- When adding tax rates on a subscription, you have the option choose whether the tax is inclusive or exclusive.

- Fixed amount fees are always exclusive.

- You cannot configure the tax calculation of Billing Plan Addons. They always follow the tax calculation setting of the parent product.

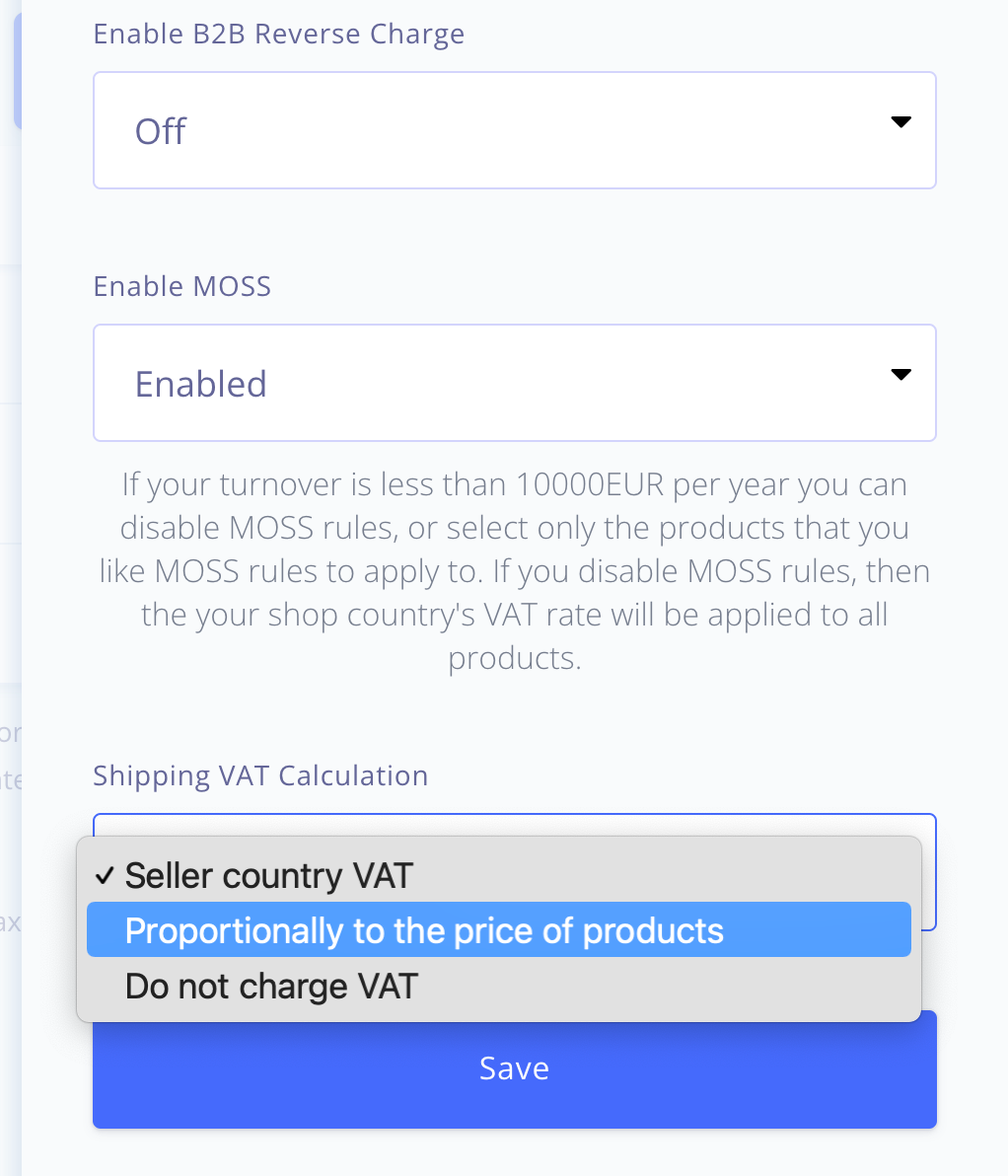

Shipping VAT Calculation (Beta)

We have expanded our EU VAT Calculation engine by offering more options on how shipping VAT is calculated. You can now choose between 3 options when it comes to calculating shipping VAT:

- Charge Merchant VAT Rate (default)

- Charge proportionally to the product prices (mixed VAT support according the category of the product).

- Do not charge any shipping VAT

Recurring Custom Invoices

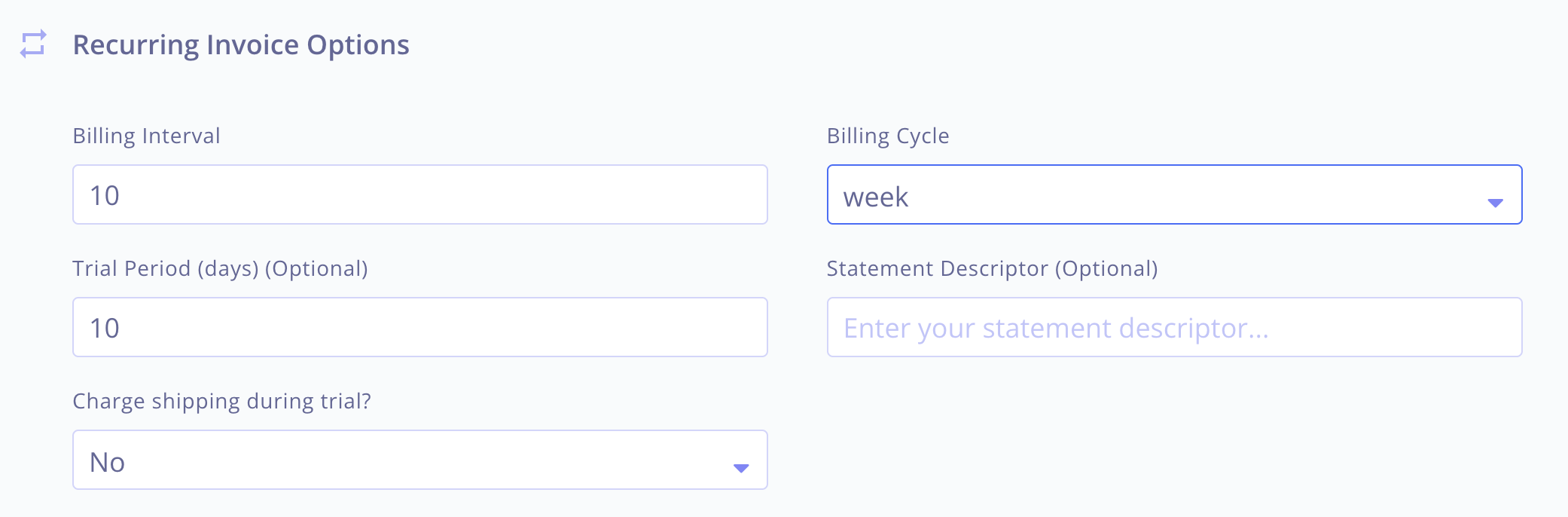

If you have a Stripe account, you can now invoice your customers on a recurring basis when creating custom invoices. You can configure the billing interval, billing cycle and whether to charge shipping during trial (if the invoice supports shipping).

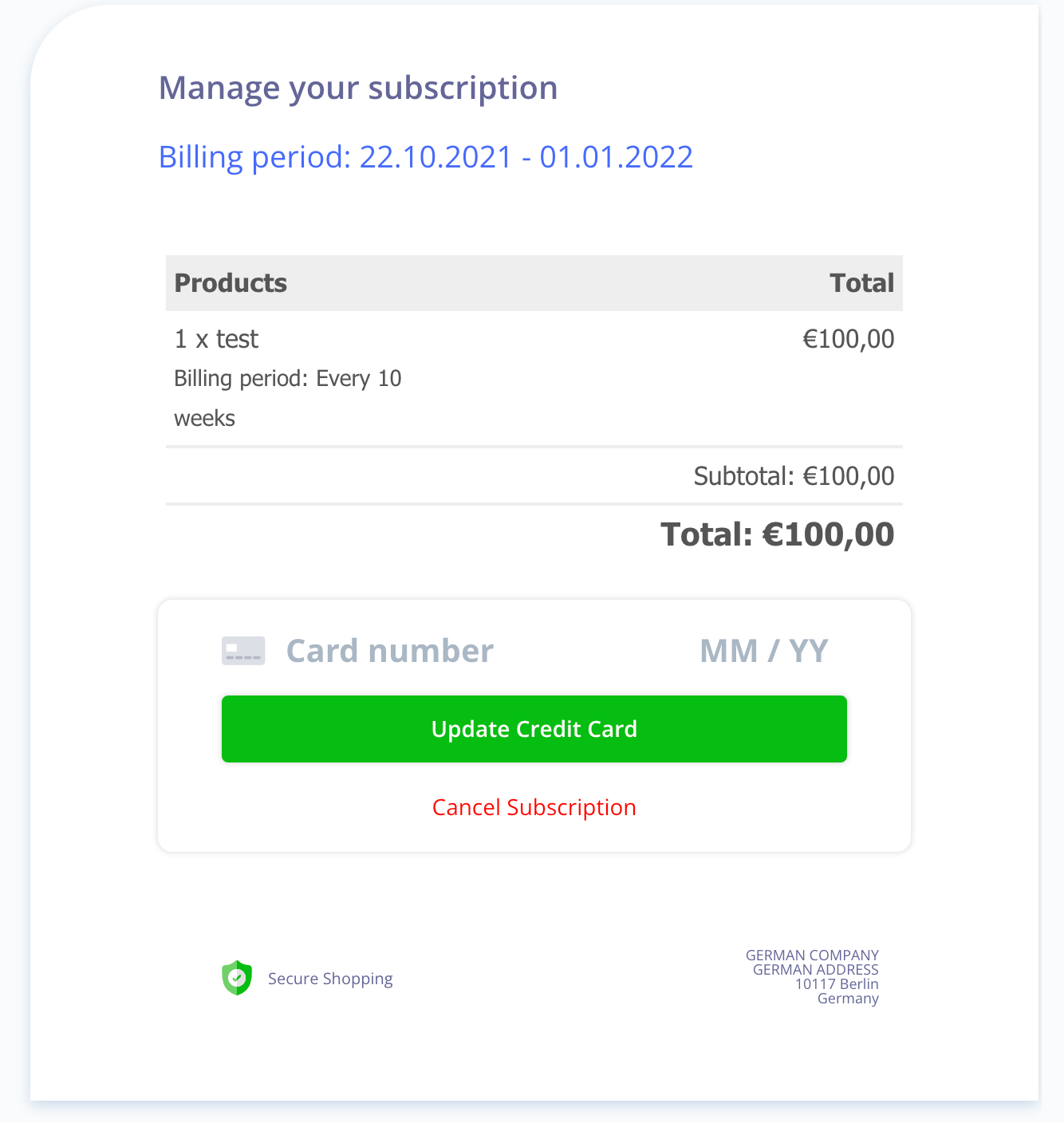

When the customer completes their first payment for the recurring invoice, a subscription will be created which you can access and manage by visiting the "Live Subscriptions" section from the sidebar.

The customer will receive a hosted link where they can manage their recurring invoice with options to update their registered card, approve plan switching, cancel the invoice and more.

Notes:

- When creating a recurring invoice you cannot use existing inventory items.

- Having a Stripe account is a pre-requisite in order to create recurring invoices.

- EUR currency based invoices can enable SEPA payment options such as iDEAL and Sofort for the customer to use. For the rest of the currencies only credit cards can be enabled.

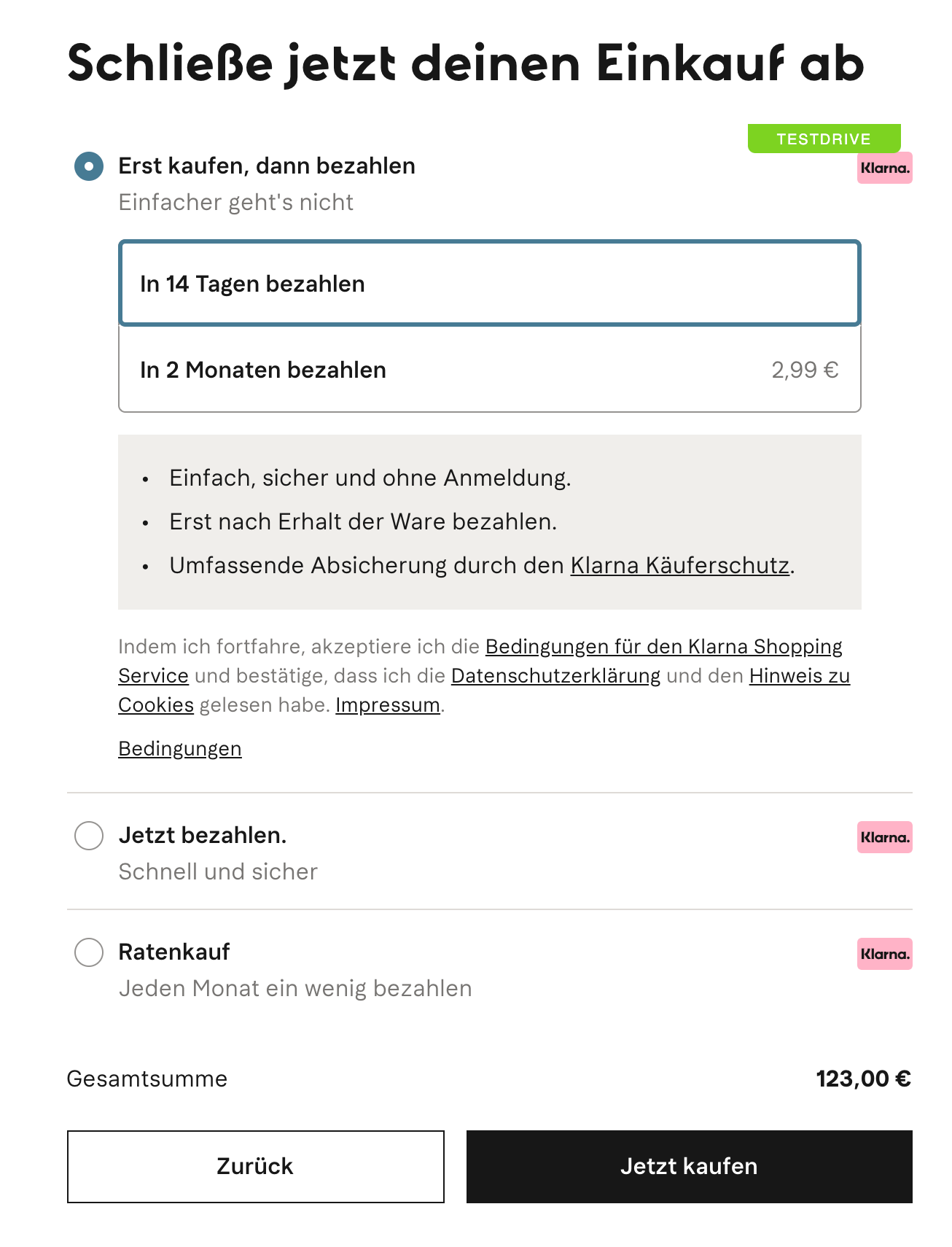

Stripe merchants in Austria, Belgium, Denmark, Finland, France, Germany, Italy, the Netherlands, Norway, Spain, Sweden, the United Kingdom, and the United States can now accept payments with Klarna. The requirements to use Klarna are:

- You own a Stripe account based one of the supported countries;

- You are selling in EUR, USD, GBP, DKK, SEK, or NOK;

- Your customers are from Austria, Belgium, Denmark, Finland, France, Germany, Italy, the Netherlands, Norway, Spain, Sweden, the United Kingdom, or the United States.

- Klarna has to be activated in your Stripe dashboard

Based on your customer’s country and amount, Klarna offers various payment options. The options offered to the customer include:

- Instalments: 3 - 4 payments

- Pay later: Pay for the purchase in 14, 21, or 30 days.

- Financing: Spread the cost of a purchase over multiple months.

- Pay now: Pay for the purchase immediately

Klarna is available across the whole plug&paid platform, including plugs, invoices and affiliate payouts.

Note:

- Subscriptions via Klarna are not supported.

- Apart from the standard "prohibited businesses" restrictions; Charities, political organisations and general initiatives are not allowed to use Klarna.

- Refunds are available within 180 days for payment confirmation and may take up to 7 business days to be completed.

- Dispute processes are handled by Klarna and they may contact you for clarifications in the event that a customer files a dispute.

- If your Stripe account is based in the United States, then only customers for the United States can use Klarna as a payment gateway.

Improvements

- Added support for Albania

- Added support for Albanian LEK

- You can now mark any invoice as "paid", regardless of how the invoice was created or what payment method was used

- You can now update the tracking number for a sale on demand

- You can now choose whether to send an email to the customer when adding a tracking number on a sale

- Merchants will receive separate emails when an instalment payment fails.

- Added a new page: "Cancelled Instalments" which you can access from the sidebar.

- You can now filter statistics for custom invoices in the dashboard.

- We updated the sales export and DateV export features.

- We updated the content for payout confirmation.

Bug Fixes

- Fixed a bug where digital downloads would not keep the original file name and instead were showing auto-generated name.

- Fixed the localisation and messaging of credit card errors at checkout when attempting to create a subscription.

- Fixed a bug that was showing "invalid date" as the cancellation date of a cancelled subscription.

- Fixed a UX issue where the actual number of subscriptions for a customer was not showing correctly.

- Fixed a "not authorized" problem when marking pending orders as done.

- Fixed a UX issue where the pending orders number was not updating correctly

- Fixed an issue that was causing invoice downloads to use the merchant's account language instead of the sale language.

- Fixed a bug with the subtotal amount being off when exporting sales CSV

Join the conversation.